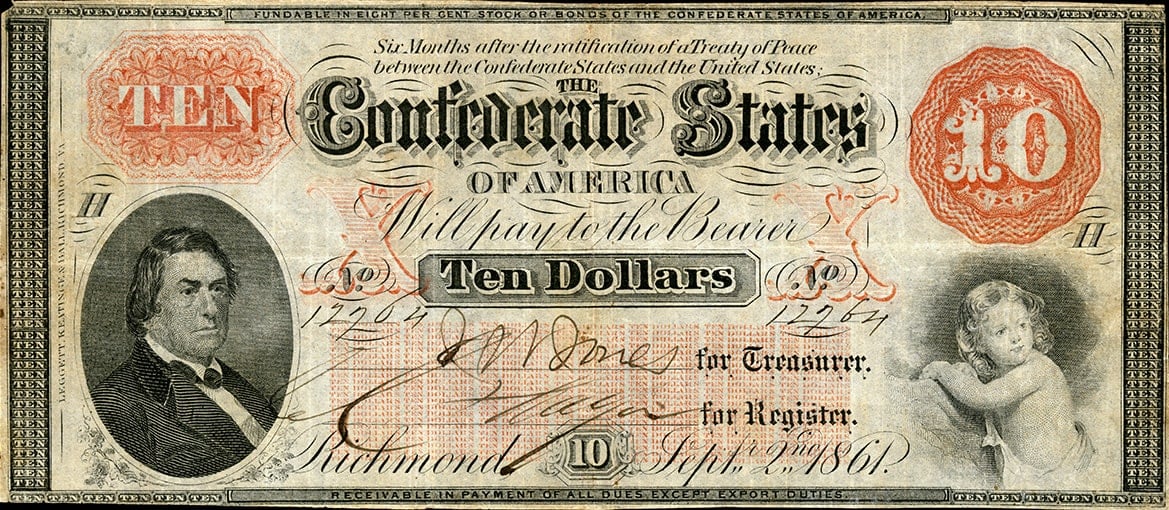

PHOTO CREDIT: A sample of a Confederate ten-dollar bill posted for sale at bradfordauction.com is now sold as a novelty item for collectors. Issued by the now defunct Confederate government, its only real value is in its collectability.

Crypto Hesitancy: Still Think That 'Cash Is King'?

Think Again.

When it comes to crypto hesitancy, we often hear the argument that cash is the only truly private mode of money. But is that assumption correct?

As it stands, the US dollar is a fiat currency. That is to say that the physical dollar itself has no value, unless we as consumers acknowledge that value. Gold can be buried under your front step, found a generation from now, and still be gold. It can still have value. But the dollar—no longer a representation of holdings of physical gold--cannot hold that value unless the agreement that it is worth a dollar is acknowledged. That acknowledgement only happens based on the assurance and overall stability of the government issuing the note. If that nation fails, its money is worthless. Just ask the Confederacy.

Despite our relative comfort in the value of the Dollar, Yen, or Euro as assured by our respective governments, there are issues with such an arrangement. The money is managed by a central authority—a central bank. That bank controls the ebb and flow of the dollar’s value. Too much money printed means the value of that money plummets. Too little, and the economy sputters and starves. In this way, governmental and central banking manipulation can wreak havoc with what you’ve earned and saved, because it continuously monitors and it determines every dollar’s value. You may love your cash, and you’ve got that right—you’ve earned it. But you have little say in what it’s actually worth.

And it gets worse. Old assurances about the anonymity of using cash are now sadly overestimated. Cash transactions, however tightly the release of that cash maybe controlled, have until recently been the only means of conducting private transactions aside from bartering. In other words, if you sell me a widget, and I purchase the widget, we may do so privately through the exchange of the dollar bills that we agree hold value. While the government has made clear that it would like to know about the exchange of that widget, we have the pretense of some right to make that deal privately. But the times… oh they are a changin’.

In a recent interview, Edward Snowden—a former adjunct of the CIA/NSA and expert whistleblower in matters of privacy and security—pointed out that crypto hesitancy is based on a false premise: the idea that cash is king. “We actually still believe things” claims Snowden “... we believe things like the idea that cash is anonymous, and that’s no longer actually true. You know those cash counters that you see? The bank, they put like a stack of money, and it pulls it through, and it says, “These bills are for these things”. Those cash counters now--they actually scan the serial number of every bill. And they keep a database of every serial, of every bill.”

An even more disturbing reality, according to Snowden, is what is done with that data. “And guess what those cash counters are, now? Yeah. They’re networked. And so, this is the thing…these are just the challenges we face.”

Snowden points out that cash is not at all private if it’s spent with any seller that does banking. “Maybe they don’t know what you spent that money on” he asserts; but they can infer it. “They know that this cash was deposited by this business at this bank… and the last time that this system writ large saw this bill was over in this state, withdrawn by this person, at that time.”

Snowden points out that cash deposited in a bank is held and converted to digital data, which is absolutely trackable and traceable. He further asserts that the banks and federal government work in lock step to maintain these databases. “And we have no idea how the Federal Government is using these programs. We have no idea how the banks are—what sort of surveillance and link analysis of how… financial flows occur.” To that end, Snowden argues that the biggest misconceptions about money, and how it is tracked, is that cash is still…well…cash.

With cryptocurrency however, the central authorities that do the tracking and reporting are organically reigned in. While blockchain technology presents some valuable security in exchanges, it cannot be anything more than pseudo-anonymous. That is to say that blockchain-based cryptocurrencies are held on a public ledger that is indomitable: it never goes away. And that permanence, asserts Snowden, combined with increased detection technology, means a veritable smorgasbord of tracking and tracing opportunities for the very authorities that crypto users strive to avoid.

The value of any crypto dollar, just like cash, holds value based on the agreement of its value between buyer and seller. Cash is converted to digital dollars whether you see it happen or not, and its value is always premised on some agreement or assurance of its issuer. The assertion by naysayers is that cryptocurrencies are risky and worthless. However, the same can be said for the alternative they tout: the easily traceable and trackable US dollar.

At CloudCoin, the security protocols upon which our crypto is based—known as RAIDA technology—doesn’t use blockchain protocols. As a result, there are no accounts, no ledgers, no cumbersome strings of code, and there is no “cash counter” reading and reporting serial numbers. It’s just you, your transactions, and light, simple lines of code that can go with you… in milliseconds. So, in this sense, it could very well be that–as it relates to privacy and assurity– CloudCoin may be king.